Expanding Reserve funds with the Rytary Reserve funds Card: A Far reaching Guide

Presentation: In the domain of dealing with Parkinson’s sickness, it is vital to get to reasonable medicine. Luckily, for those recommended Rytary, a cutting edge treatment for Parkinson’s side effects, the Rytary Reserve funds Card remains as a signal of monetary help. This article digs into the advantages, qualification models, and commonsense usage of the Rytary Reserve funds Card, engaging patients and parental figures to explore the medical services scene with certainty.

Figuring out Rytary: Rytary, a blend of carbidopa and levodopa, is a prescription prestigious for its viability in easing the engine side effects of Parkinson’s sickness, like quakes, solidness, and gradualness of development. Its one of a kind expanded discharge detailing gives supported help, upgrading patient versatility and personal satisfaction.

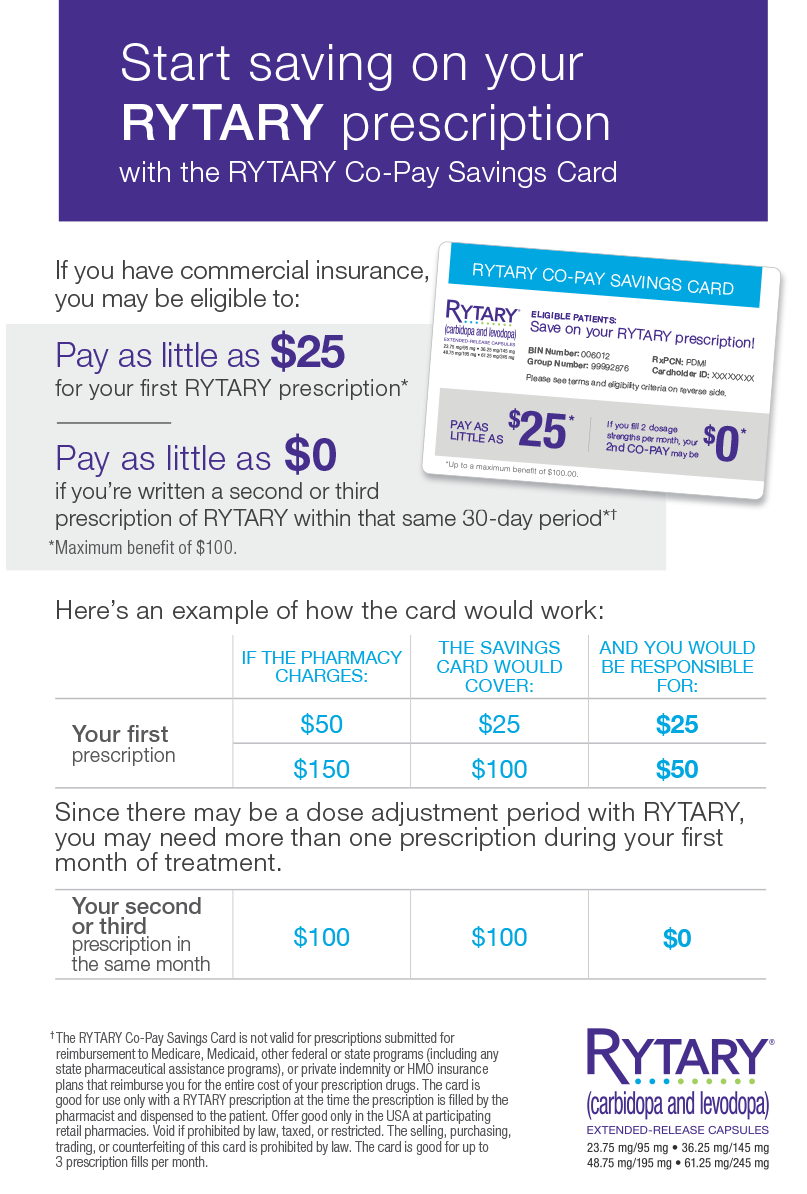

The Job of the Rytary Investment funds Card: Perceiving the monetary weight related with persistent circumstances like Parkinson’s infection, the creators of Rytary have presented an Investment funds Card program. This drive intends to diminish personal costs, guaranteeing that patients can manage the cost of steady admittance to their endorsed drug.

Advantages of the Rytary Investment funds Card: The Rytary Investment funds Card offers significant advantages, including:

Huge Expense Decrease: Qualified Rytary savings card patients might pay just $10 for each Rytary medicine, possibly saving many dollars per top off.

Simple Initiation: Enactment of the card is a straightforward interaction, regularly requiring culmination of a web-based structure or a call to select.

Wide Qualification: The Reserve funds Card is accessible to industrially protected patients and those without protection inclusion, growing openness to a more extensive segment.

Long haul Reserve funds: Patients can use the card for numerous solutions consistently, building investment funds over the long haul and facilitating the monetary strain related with continuous treatment.

Qualification Models: While the Rytary Reserve funds Card stretches out its advantages to numerous patients, certain qualification measures should be met. These frequently include:

Being an inhabitant of the US or its domains.

Having business protection that covers Rytary or being uninsured.

Not being signed up for any administration subsidized medical care program, like Federal health insurance or Medicaid.

Agreeing with any extra necessities illustrated by the Investment funds Card program.

Using the Rytary Investment funds Card: Boosting the advantages of the Rytary Reserve funds Card includes a couple of basic advances:

Enlistment: Patients can sign up for the program online through the authority Rytary site or by calling the gave hotline.

Introducing the Card: After getting a solution for Rytary, patients ought to introduce their Investment funds Card to the drug specialist during checkout.

Reserve funds Application: The drug specialist will apply the card, naturally changing the patient’s personal costs to the limited rate.

Reestablishment: Patients ought to guarantee their card stays dynamic by recharging it as needs be, commonly on a yearly premise or as indicated by the program.

End: Exploring the intricacies of medical care costs can be overwhelming, particularly for people overseeing persistent circumstances like Parkinson’s infection. Notwithstanding, with drives like the Rytary Reserve funds Card, the monetary boundaries to getting to indispensable medicine are altogether decreased. By figuring out the advantages, qualification measures, and commonsense use of the Rytary Reserve funds Card, patients and guardians can make proactive strides towards upgrading their treatment process while limiting monetary strain.